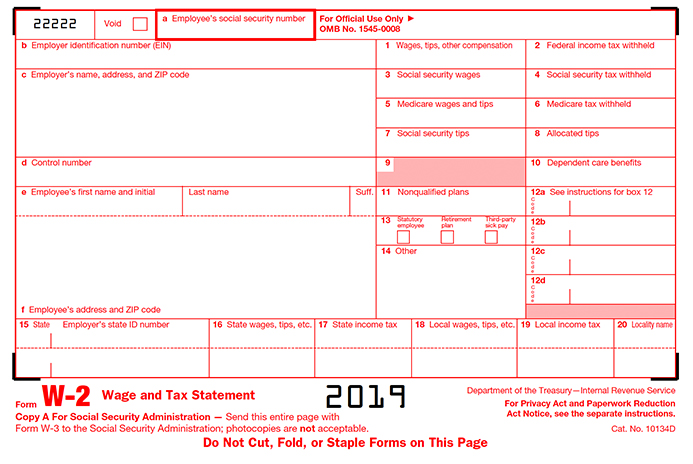

Form W-2 is recognized as the document that an employer is needed for sending to his employees plus the IRS (Internal Revenue Services) towards the finishing of a year. This Form does report the annual wages of an employee besides the amount of taxes that are withheld from his paychecks. By W-2 employee is meant someone whose employer removes taxes and defer to the government.

An employer is required to file Form W-2 for the wage tax return that is paid to every employee from whom:

- Social Security, Income, or Medicare tax have been withheld or

- Income tax would be withheld when the employee had claimed only one withholding allowance. Again, it is also applicable when the employee hasn’t claimed exception from withholding on W-4 Form, which is also known as Withholding Allowance Certificate of an employee.

Every employer who is engaged in a business or a trade and pays remuneration for an employee’s services that comprise non-cash payments should file W-2 Form for every employee. It turns true when even the employee is connected to the employer.

There are 6 copies in Form W-2

- Copy 1 for the state, city, or local tax department

- Copy A for Social Security Administration

- Copy B To Be Filed With Employee’s FEDERAL Tax Return

- Copy C for Employee’s Records

- Copy 2 To Be Filed With Employee’s State, City, or Local Income Tax Return

- Copy D for Employer

Visit irs.gov to know more about Form W-2.

What is the due date for Form W-2?

Employers must file Form W-2 with the IRS before January 31st. Also, the copies should send to the employees before the due date January 31st.

How should you complete Form W2?

An employer can file Form W-2 either paper or electronically.

Employers can file manually through the use of a fillable PDF form with purchased software or on the SSA site. Again, an employer can also make use of the small business form of tax preparation software, when it has got this feature. Alternatively, you can make use of a payroll service or a tax preparation service for preparing, filing, as well as sending a W-2 form.

Where should you mail Form W-2?

A person might e-file Form online to the SSA via his Business Services Online unit. However, he doesn’t need to comprise the W-3 form when he sends the form online. However, there isn’t any extension for the filing deadline.

You can also send paper Form W-2 through the SSA through mail

When you have decided to submit the form through mail then you have to follow the steps like: Send the forms through the Postal Service of the US to the SSA at a specific address mentioned

- Social Security Administration

- Direct Operations Center

- Wilkes-Barre,

- PA 18769-0001

Now, if you file W-2 lately, then you should make use of a private delivery service, like Federal Express or UPS for getting there overnight and here, the address would be different from the above address.

What about penalties and interest if you miss the deadline?

The penalties for Form W-2 late filing are steep as you can be fined an amount between $50 and $260 and this is the charge for one form only. The fines are dependent on how late your mailing has been. Again, late filing of ten forms will result in penalties of $500 – $2600 based on the date of your late filing.

Also read: What Employers Need to Know about 941 Quarterly Tax Return?